INTRODUCTION

Healthcare Fundraising is instrumental for securing the necessary staffing, equipment,

and facility renovations your organization needs to function at maximum

capacity. Healthcare fundraising enables to pay their business costs, and more

importantly, develop their facilities to better serve the needs of patients.

Some core fundraising needs for healthcare organizations may include:

● Employee costs

● Facility renovations

● Upgraded equipment

● Improved patient care services

Considering the above facts, Hospaccx team participates in fundraising for healthcare

organisation. This is macroficial study of Preparation of fundraising for Private Equity &

Venture Capital for Healthcare Organisation, if you want to get into more detail you can

contact hospaccxconsulting.com

PRIVATE EQUITY

Private equity is an alternative investment class and consists of capital that is not

listed on a public exchange. Private equity is composed of funds and investors that

directly invest in private companies, or that engage in buyouts of public companies,

resulting in the delisting of public equity.

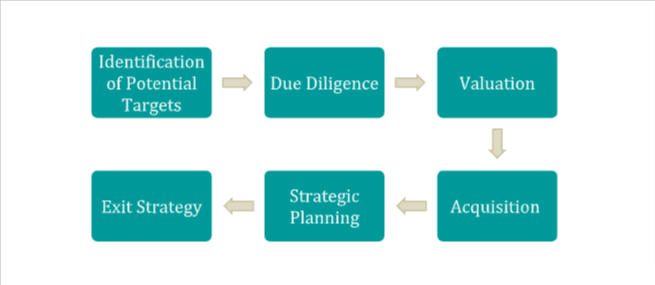

The process flow of private equity in healthcare organizations typically involves the following steps:

- Identification of Potential Targets: Private equity firms typically identify potential acquisition targets through their own networks, industry research, and other sources. Healthcare organizations may be targeted based on factors such as market position, growth potential, and financial performance.

- Due Diligence: Once a potential target has been identified, the private equity firm will conduct extensive due diligence to assess the organization’s financial, operational, and legal status. This includes reviewing financial statements, conducting market research, and assessing the organization’s regulatory compliance.

- Valuation: Based on the results of due diligence, the private equity firm will determine the value of the organization and negotiate the terms of the acquisition.

- Acquisition: The private equity firm will typically acquire a controlling interest in the healthcare organization, often through a combination of debt and equity financing.

- Strategic Planning: Once the acquisition is complete, the private equity firm will work with the healthcare organization’s management team to develop and implement a strategic plan for the organization. This may involve restructuring operations, investing in new technology or infrastructure, and exploring new growth opportunities.

- Exit Strategy: Private equity firms typically have a specific exit strategy in mind when they acquire a healthcare organization. This may involve selling the organization to another investor or taking the company public through an initial public offering (IPO).

Throughout this process, private equity firms will work closely with healthcare organizations to ensure that they are able to achieve their strategic goals and maximize their value to investors.

Benefits of private equity

- Capital infusion: Private equity firms can provide significant capital investment to healthcare organizations, allowing them to invest in technology, equipment, and infrastructure to improve patient care.

- Operational expertise: Private equity firms often have deep industry knowledge and can provide healthcare organizations with operational expertise to help them optimize their operations and improve efficiency.

- Access to networks: Private equity firms have extensive networks that healthcare organizations can tap into to expand their reach, find new partners, and identify new opportunities.

- Improved governance: Private equity firms can bring a new level of corporate governance to healthcare organizations, which can help improve accountability and transparency.

- Growth opportunities: Private equity firms can help healthcare organizations identify new growth opportunities and develop strategies to take advantage of them.

- Improved patient outcomes: By investing in new technology, equipment, and infrastructure, private equity firms can help healthcare organizations improve patient outcomes and provide better care.

- Increased market competitiveness: Private equity firms can help healthcare organizations become more competitive by investing in marketing, branding, and other initiatives to increase their visibility and attract new patients.

- Talent acquisition: Private equity firms can help healthcare organizations attract and retain top talent by providing resources for training and development, as well as competitive compensation packages.

VENTURE CAPITAL

Venture capital (VC) is the process of raising money from individuals and firms that invest in high growth, high risk healthcare organisation. To compensate for higher risk, venture capital investors (VCs) expect a large return on their investment, higher than say a bank would expect.

Process for venture capital

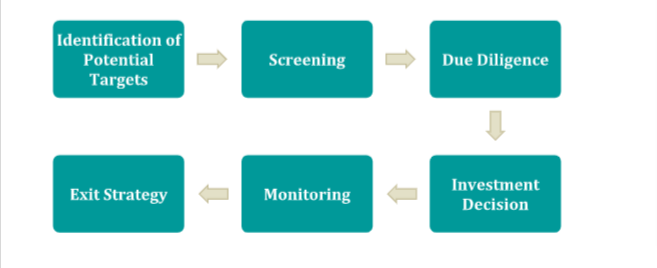

The process flow of venture capital in a healthcare organization typically involves the following stages:

- Identification: The first step in the process is identifying potential healthcare organizations that meet the investment criteria of the venture capital firm. This may involve conducting market research, attending industry conferences, and networking with industry experts.

- Screening: Once potential investment opportunities have been identified, the venture capital firm will typically conduct a preliminary screening to assess the suitability of the healthcare organization. This may involve reviewing the organization’s financial statements, market position, and management team.

- Due diligence: If the healthcare organization passes the screening stage, the venture capital firm will conduct a more detailed due diligence process. This may involve reviewing the organization’s legal and regulatory compliance, clinical trial data, intellectual property portfolio, and other key metrics.

- Investment decision: Based on the results of the due diligence process, the venture capital firm will make an investment decision. This may involve negotiating the terms of the investment, including the amount of funding, the valuation of the healthcare organization, and the rights and responsibilities of the investor.

- Monitoring: Once the investment has been made, the venture capital firm will typically monitor the performance of the healthcare organization on an ongoing basis. This may involve regular reporting, board meetings, and strategic planning sessions.

- Exit: Finally, the venture capital firm will seek to exit its investment in the healthcare organization. This may involve selling its stake to another investor, taking the company public through an IPO, or selling the company outright to a strategic acquirer. The timing and method of the exit will depend on a variety of factors, including market conditions, the performance of the healthcare organization, and the preferences of the investor

Benefits of venture capital

- Access to funding: Venture capital provides startups and other high-growth companies with access to capital that may be difficult to obtain from traditional lenders or through public markets.

- Strategic guidance: Venture capital firms often bring expertise and industry knowledge that can help startups grow and succeed. This can include guidance on product development, marketing, and hiring, among other areas.

- Networking opportunities: Venture capital firms typically have extensive networks that can help startups connect with potential partners, customers, and other investors.

- Validation: The fact that a startup has received venture capital funding can provide validation and credibility to potential customers, employees, and other stakeholders.

- Long-term support: Unlike some other types of investors, venture capital firms are typically committed to supporting their portfolio companies over the long term, with a focus on achieving sustained growth and profitability.

- Flexibility: Venture capital investments can be structured in a variety of ways, including equity, debt, or convertible notes. This flexibility can help startups manage their cash flow and balance their need for funding with their desire to retain control over their company.

- Potential for high returns: Venture capital investments can provide significant potential returns to investors, with the possibility of a high return on investment if the startup is successful.

CONCLUSION

Private equity firms mostly buy mature companies that are already established, while venture capital firms are limited to start-ups i.e., early-stage company. Private equity firms mostly buy 100% ownership of the healthcare organisations in which they invest. Venture capital firms invest in 50% or less of the equity of the healthcare organisations. Private equity firms use both cash and debt in their investment, but venture capital firms deal with equity only. There are major differences in these two types of funding. It is important to consider the healthcare organisations business plans, future growth plans, future financial growths, past and current records while selecting the type of funding.

Related Team Members