Hospital Due Diligence

What Is Hospital Due Diligence?

Hospital due diligence is a structured, multi-dimensional assessment process conducted prior to key transactions such as mergers, acquisitions, strategic partnerships, fundraising, or hospital turnarounds. Its goal is to provide a 360-degree understanding of a hospital’s assets, risks, operations, and long-term value.

This process encompasses financial audits, operational reviews, legal verifications,infrastructure assessments, and clinical governance analysis. In essence, it helps stakeholders make data-driven, risk-mitigated decisions in a highly regulated and complex environment.

Hospaccx Healthcare

What does healthcare due diligence mean for medical organizations?

It ensures that companies achieve their transaction goals and offers the following benefits to clinics and patients.

Value to clinics/Hospitals

- Better risk assessment

- Thoughtful deal evaluation

- Helpful integration insights

Value to patients

- Better care quality in deals by private equity firms

- Lower service costs

Why Is Hospital Due Diligence Crucial?

In the fast-evolving healthcare industry, where stakes are high and compliance is critical, due

diligence ensures .

Uncovers hidden liabilities, ongoing litigations, and regulatory gaps.

Aids in arriving at a fair and defensible valuation.

Identifies growth opportunities, market threats, and integration

challenges.

Prevents post-transaction fallout due to missed red flags.

Verifies statutory licenses and NABH, JCI, or other

accreditation statuses.

Reveals inefficiencies, resource gaps, and patient service

bottlenecks .

Hospaccx Healthcare

How Is Hospital Due Diligence Conducted?

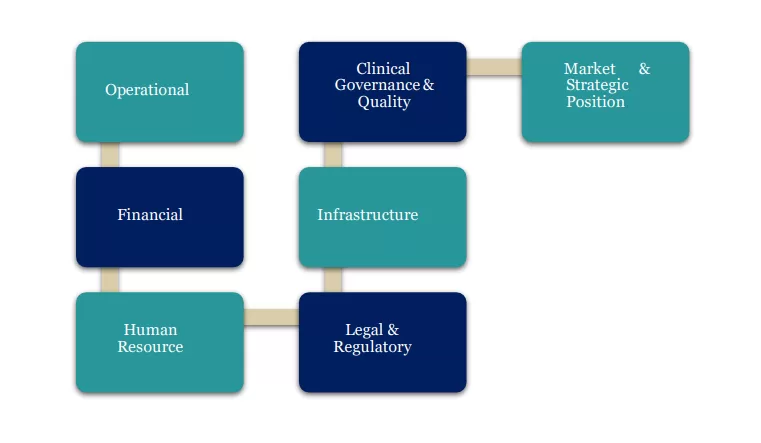

Due diligence in the hospital sector involves several layers of investigation, each focused on a different domain. The steps of Due Diligence are given below:

Operational Due Diligence

Operational due diligence involves an analysis of the hospital’s operational processes, and systems.The objective is to evaluate the hospital’soperational efficiency,identify anypotential operational risks, and assess the potential for operational synergies post- transaction.

Evaluates the hospital’s functioning, capacity, and technology use:

• Bed strength vs occupancy

• Departmental services & specialties

• OPD/IPD/emergency volumes

• Accreditation (NABH, JCI)

• Telemedicine, HIS, and EHR usage

Operational Due Diligence includes :-

Bed capacity and occupancy rates

Evaluating the number of available beds and actual utilization to understand patient load management.

Range of clinical departments and service offerings

Assessing the range and specialization of services such as cardiology, orthopaedics, ICU, diagnostics to determine care diversity.

Patient volumes (OPD, IPD, Emergency)

Analyzing footfall across different service zones for a clear picture of operational throughput.

Accreditation status (e.g., NABH, JCI)

Verifying quality certifications that reflect adherence to national and international healthcare standards.

Financial Due Diligence

Financial due diligence involves an analysis of the organization’s financial statements revenue streams, cash flow, debt obligations, and other financial metrics. The objective is to evaluate the organization’s financial health and identify any potential risks that may impact the transaction. Financial due diligence also helps in determining the fair value of the organization, which is crucial in negotiating the terms of the transaction.

Analyzes financial health and revenue models:

• IPD/OPD/pharmacy/lab income breakdown

• Profit & loss trends, cash flow analysis

• Tax compliance, TPA receivables, bad debts

• Capital investments and debt servicing

Financial Due Diligence includes :-

Revenue Streams (IPD, OPD, Diagnostics, Pharmacy)

Analyzing income sources to understand how the hospital earns — from inpatient care to outpatient services and ancillary units.

Profit & Loss Statements, Cash Flow, and Debt Analysis

Reviewing financial documents to assess profitability, liquidity, and existing liabilities.

Audit Reports, Tax Filings, and Receivables

Examining audited accounts and compliance with tax obligations; understanding outstanding payments.

TPA and Insurance Payment Cycles

Evaluating the billing and collection processes from third-party administrators and insurance providers

Human Resource Due Diligence

A thorough review of the hospital’s workforce and HR practices ensures that human capital isaligned with operational goals and compliant with labor laws.

Assesses workforce strength, morale, and legal compliance:

• Doctor/nurse ratios

• Employment contracts and attrition rates

• Payroll structure and PF/ESIC/statutory compliance

• Staff training and CME programs

Human Resource Due Diligence includes` :-

Doctor and Nursing Staff Ratios

Assessing staffing adequacy and alignment with clinical standards — especially in critical areas like ICU and emergency care.

Training and Continuing Education Programs

Understanding the institution’s investment in staff development through CME, skill-building workshops, and certifications.

Payroll Structure and HR Compliance

Evaluating salary frameworks, incentives, statutory benefits, and adherence to labor regulations.

Employment Contracts and Retention Rates

Reviewing the terms of staff engagement and analyzing turnover to identify stability or gaps in workforce management.

Legal & Regulatory Due Diligence

This process ensures that the hospital complies with all applicable legal and regulatory requirements, minimizing risk and ensuring operational legitimacy.

Ensures legal integrity and risk-free operation:

• Licenses: Fire NOC, Pollution, Biomedical Waste, etc.

• Property & land title checks

• Existing lawsuits or malpractice claims

• Vendor and consultant contract reviews

Legal & Regulatory Due Diligence includes :-

Licenses & Approvals

(Fire NOC, Clinical Establishment, PC-PNDT, Biomedical Waste, etc.) Verification of all mandatory statutory licenses and permits.

Land Titles & Property Documentation

Review of ownership records, lease agreements, and land-use permissions.

Ongoing Litigations or Medical Malpractice Cases

Identification of any pending legal disputes, litigations, or historical malpractice issues.

Third-party Contracts & Vendor Agreements

Examination of legal contracts with outsourced vendors, consultants, and service providers.

Infrastructure Due Diligence

This assessment evaluates the physical and technological framework of the hospital to ensure safety, efficiency, and long-term sustainability.

Evaluates physical and digital infrastructure:

• Building age, structure safety, maintenance history

• HVAC, MGPS, lifts, emergency readiness

• PACS, LIS, EMR, and billing system effectiveness

• Cybersecurity and IT resilience

Infrastructure Due Diligence includes :-

Age and Condition of the Building

Inspection of structural integrity, layout, and maintenance history of the hospital facility.

Emergency Preparedness and Fire Safety Systems

Review of fire alarms, extinguishers, evacuation plans, and disaster response protocols.

Medical Gas Pipeline, HVAC, Lift Systems

Evaluation of critical building systems ensuring operational safety and compliance.

IT Infrastructure (Billing Software, PACS, EMR)

Assessment of digital systems supporting hospital operations, diagnostics, and record-keeping

Clinical Governance & Quality Review

This review ensures the hospital maintains high standards in patient care, safety, and clinical effectiveness.

Focuses on care quality and safety metrics:

• SOPs, protocol adherence

• HAI (hospital-acquired infection) rates, mortality rates

• Internal clinical audits and patient feedback systems

• Medication safety, adverse event tracking

Clinical Governance & Quality Review includes :-

SOPs and Clinical Protocols

Evaluation of the availability and adherence to standard operating procedures and evidence-based practices.

Infection Control & Patient Safety

Review of hygiene practices, isolation protocols, and key safety metrics.

Clinical Outcomes (HAI Rates, Mortality Rates)

Analysis of hospital-acquired infection data, mortality trends, and other critical performance indicators.

Internal Audits & Feedback Mechanisms

Assessment of internal quality audits and the effectiveness of patient feedback and grievance redressal systems

Strategic & Market Position Analysis

This component examines the hospital’s positioning within the healthcare landscape to identify opportunities and risks.

Determines long-term sustainability and community impact:

• Market share, branding, patient catchment analysis

• SWOT, risk mapping, and competitive benchmarking

• ESG (Environmental, Social, Governance) practices

• Community health contributions and CSR impact

Strategic & Market Position Analysis includes :-

Catchment Area & Patient Demographics

Analysis of geographic reach, community health needs, and population profiles served.

Reputation, Market Share & Referral Networks

Evaluation of brand perception, competitive standing, and strength of physician or institutional referral ties.

SWOT Analysis

A structured review of internal strengths and weaknesses, alongside external opportunities and threats to inform strategic planning

Hospital due diligence is applicable in several contexts, including :-

Joint Ventures and Strategic Alliances

Assessment of internal quality audits and the effectiveness of patient feedback and grievance redressal systems

Private Equity or Investor Funding

To inform decisions before capital infusion.

Mergers and Acquisitions

To evaluate the target hospital’s value and liabilities.

Hospital Turnaround Projects

To identify root causes of inefficiency

Post-Transaction Integration Readiness (Often Missed)

Compatibility of systems and culture Integration of SOPs, billing, HR, and IT systems Stakeholder alignment (clinicians, promoters, management)

Use Cases of Hospital Due Diligence

• Mergers & Acquisitions

• Joint ventures & strategic alliances

• Investor or private equity funding

• Hospital turnaround consulting

• Public-private partnerships (PPPs)

• Network expansion and franchise vetting

Blogs

THE HEALTHCARE SCENARIO OF IVF IN INDIA

April 24, 2025

No Comments

THE HEALTHCARE SCENARIO OF ONCOLOGY IN INDIA

April 24, 2025

No Comments

Related Team Members

Dr. Tarun Katiyar

Hospaccx Healthcare

How Hospaccx Healthcare Business Consulting Supports Hospital Due Diligence

Hospaccx Healthcare Business Consulting brings specialized expertise to ensure your due diligence is comprehensive, compliant, and actionable. Here’s how we support:

We manage the entire due diligence lifecycle—right from preliminary audits to post-deal

integration planning.

Our consultants include hospital planners, biomedical engineers, chartered accountants, clinical quality experts, and legal professionals—all working in sync.

We use a proprietary checklist and benchmarking model across 100+ parameters to deliver transparent, evidence-based reporting.

We help clients assess hospital valuations based on EBITDA, asset base, revenue potential,

and future scalability

Hospaccx highlights high-risk zones and compliance gaps that could derail negotiations or result in post-deal surprises.

We assess digital readiness, IT system performance, and infrastructure sustainability from a future-readiness perspective.

From biomedical waste rules to NABH audits to land use verification—we ensure you’re legally secure.

Post-due diligence, we help in crafting strategic transformation plans for growth, turnaround, or operational efficiency.