OVERVIEW OF THE INDUSTRY

India is a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports. India supplies over 50% of Africa’s requirement for generics, ~40% of generic demand in the US, and ~25% of all medicine in the UK.

India also accounts for ~60% of global vaccine demand and is a leading supplier of DPT, BCG, and Measles vaccines. 70% of WHO’s vaccines (as per the essential Immunization schedule) are sourced from India.

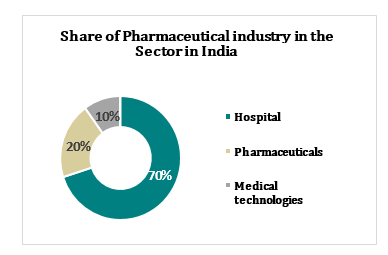

PHARMACEUTICAL INDUSTRY SCENARIO IN INDIA

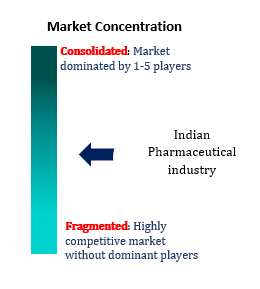

Indian pharmaceutical industry is known for its generic medicines and low-cost vaccines globally. Transformed over the years as a vibrant sector, presently Indian Pharma ranks third in pharmaceutical production by volume. The Pharmaceutical industry in India is the third largest in the world in terms of volume and 14th largest in terms of value. The Pharma sector currently contributes to around 1.72% of the country’s GDP. The industry accounts for 20 % of the healthcare sector.

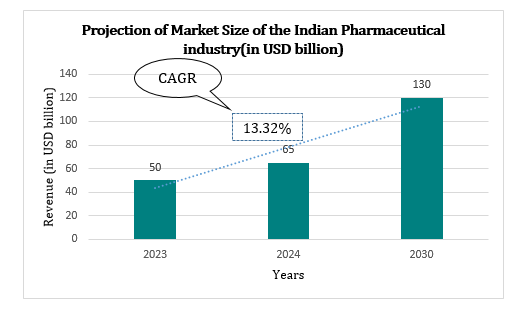

MARKET SIZE OF THE INDUSTRY

- The Indian pharmaceutical industry is worth approximately US$ 50 billion with over US$ 25 billion of the value coming from exports.

- The market size of India’s pharmaceuticals industry is expected to reach US$ 65 billion by 2024, and ~US$ 130 billion by 2030.

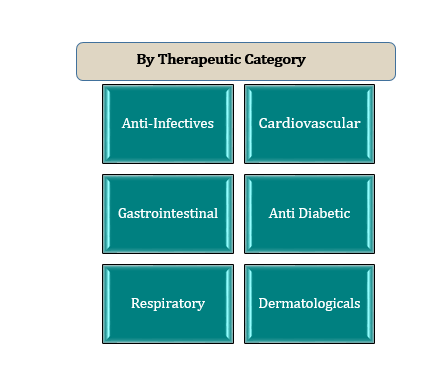

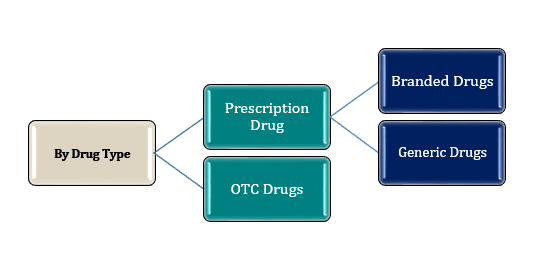

MARKET SEGMENTATION OF THE INDUSTRY

The India Pharmaceutical Market is segmented by Therapeutic Category (Anti-Infectives, Cardiovascular, Gastrointestinal, Anti Diabetic, Respiratory, Dermatologicals, Musculo-Skeletal System, Nervous System, and Others) and Drug Type (Prescription Drugs (Branded s and Generic Drugs), and Over Counter Drugs).

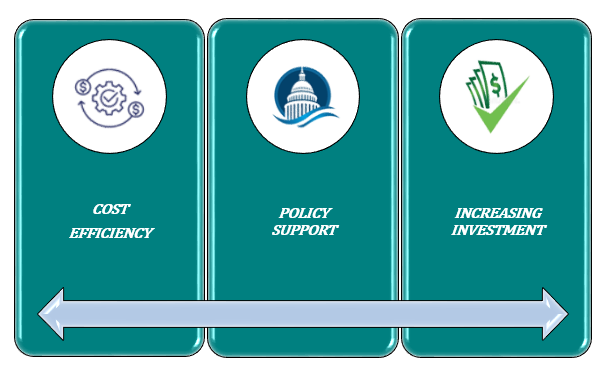

MARKET GROWTH DRIVERS OF THE INDUSTRY

- Cost efficiency

Access to affordable HIV treatment from India is one of the greatest success stories in medicine. India is one of the biggest suppliers of low-cost vaccines in the world. Because of the low price and high quality, Indian medicines are preferred worldwide, thereby rightly making the country the ‘Pharmacy of the World’.

- Policy Support

- Strengthening of Pharmaceutical Industry (SPI): The Ministry’s scheme “Strengthening of Pharmaceutical Industry (SPI)” with a total financial outlay of US$ 60.9 million (Rs. 500 crore) extends support required to existing pharma clusters and MSMEs across the country to improve their productivity, quality, and sustainability.

- Pradhan Mantri Bhartiya Jan Aushadhi Kendras (PMBJKs): The Government has set a target to increase the number of PMBJKs to 10,500 by the end of March 2025. The product basket of PMBJP comprises 1,451 drugs and 240 surgical instruments.

- Increasing Investment

- Up to 100%, FDI has been allowed through automatic route for Greenfield pharmaceuticals projects. For Brownfield Pharmaceuticals projects, FDI allowed is up to 74% through automatic route and beyond that through government approval.

- Indian pharma companies have a substantial share of the prescription market in the US and EU. The largest number of FDA-approved plants outside the US is in India.

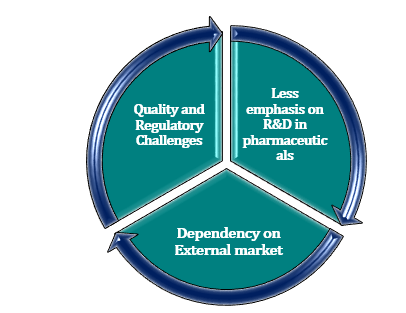

MARKET CHALLENGES IN INDIA

- Quality and Regulatory challenges: With the lack of a stable policy environment and a defined pricing regime for pharmaceutical products, the market shows considerable fluctuations in drug pricing which is something that discourages critical growth investment in third-party drug manufacturing. Also, with a wide range of third-party manufacturers for pharma in India, there’s a need for effective implementation of quality standards to ensure the delivery of reliable products to the consumer base.

- Less Emphasis on R&D: This is because, in India, there is an inadequate R&D infrastructure and lower industry-academia connection for research.

- Dependence on External market: India is heavily dependent on other countries for active pharmaceutical ingredients (API) and other intermediates. 80% of the APIs are imported from China. So India is, therefore, at the mercy of supply disruptions and unpredictable price fluctuations. Implementation of infrastructure improvement in the field of internal facilities is necessary to stabilize supply.

INDIA PHARMACEUTICALS MARKET LEADERS

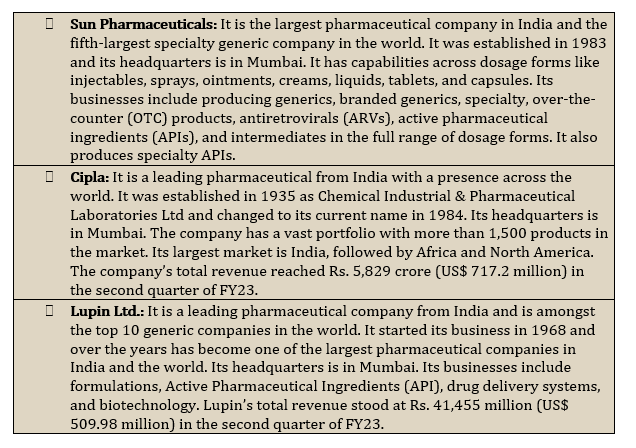

- Sun Pharmaceutical Industries Limited

- Cipla Pharmaceuticals

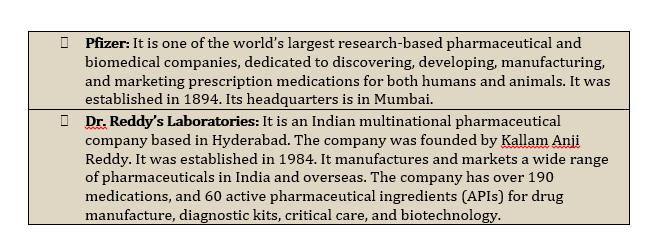

- Pfizer

- Lupin

- Reddy’s laboratories

INDIAN-BASED PHARMACEUTICAL COMPANIES

- Ajanta Pharma: It was established in 1973 and headquartered in Mumbai–India. It is a specialty pharmaceutical company providing quality medicines across 30+ countries in the world.

- Biocon: It was established in 1978 and headquartered in Bangalore. The company manufactures generic active pharmaceutical ingredients (APIs) that are sold in approximately 120 countries, including the United States and Europe.

- Bharat Biotech: It was established in 1996 and is headquartered in the city of Hyderabad. It develops and manufactures vaccines, biotherapeutics, and healthcare products.

- Emcure Pharmaceuticals: It was established in 1981. Its headquarters is in Pune. It is a major producer of HIV antivirals, as well as gynaecology and blood therapeutic drugs.

- Hamdard India: It is an Unani Pharmaceutical company. It was established in 1906 by Hakeem Hafiz Abdul Majeed in Delhi.

- Panacea Biotec: It was established in 1984. It has principal offices in New Delhi, Mumbai, and Lalru. It has business interests in research, development, manufacturing, and marketing of pharmaceutical formulations, vaccines, biosimilars, and natural products.

- Mankind Pharma: It was established in 1991. Its headquarters is in Delhi. The company has products in therapeutic areas ranging from antibiotics to gastrointestinal, cardiovascular, dermal, and erectile dysfunction medications

- Vicco group: It was established in 1952. Its headquarters is in Mumbai.

- Dabur: It was established in 1884 and its headquarters is in Ghaziabad. It manufactures Ayurvedic medicine and natural consumer products and is one of the largest fast-moving consumer goods companies in India.

- Rubicon research: It was established in 1999 with its headquarters in Mumbai, India. It is an IP-led, pharmaceutical company focused on developing value-added products for the pharmaceutical industry as well as developing a portfolio of generic prescription and OTC products across a range of therapeutic categories.

GOVERNMENT INITIATIVES

- Scheme for Development of Pharma industry – Umbrella Scheme:

The scheme of Strengthening of Pharmaceutical Industry (SPI), was launched with a financial outlay of Rs. 500 crores and the tenure from FY 2021-2022 to FY 2025-26.

The Department of Pharmaceuticals has prepared an Umbrella Scheme namely ‘Scheme for Development of Pharma industry’ ,which comprises the following sub-schemes:

- Assistance to Bulk Drug Industry for Common Facilitation Centres

- Assistance to Medical Device Industry for Common Facilitation Centres

- Assistance to Pharmaceutical Industry (CDP-PS)

- Pharmaceutical Promotion and Development Scheme (PPDS)

- Pharmaceutical Technology Upgradation Assistance Scheme (PTUAS)

CONCLUSION

The pharmaceutical industry of India is a significant player in the global healthcare sector. With a rich history and a diverse range of pharmaceutical companies, India has emerged as one of the world’s leading producers and exporters of generic drugs. It has established itself as a major global player, known for its production of affordable generic drugs, robust manufacturing capabilities, and significant exports. With a focus on research and development, a supportive regulatory environment, and continuous efforts to address challenges, the Indian pharmaceutical industry is poised for continued growth and contribution to global healthcare.

For in-depth market and financial feasibility studies or any other healthcare-related research needs, please feel free to reach out to us at +91-8655170700 or email us at hospaccx.india@gmail.com . Our team is equipped to provide comprehensive and detailed insights tailored to your specific requirements.