Introduction

A medical claim is a request for payment submitted to an insurance company,

government program, or other third-party payer for medical services rendered by a

healthcare provider to a patient.

It contains information about the patient's diagnosis, treatment, and the costs

associated with the services provided. It guarantees that the doctor is paid, that your

insurance will cover any benefits, and that you will be responsible for paying the

remaining bill if any. The purpose of the claim is to request reimbursement from the

payer for the healthcare services provided to the patient. Medical claims are typically

submitted electronically and are subject to review and approval by the payer before

payment is made to the healthcare provider. As soon as a patient arrives for an

appointment, a claim is initiated.

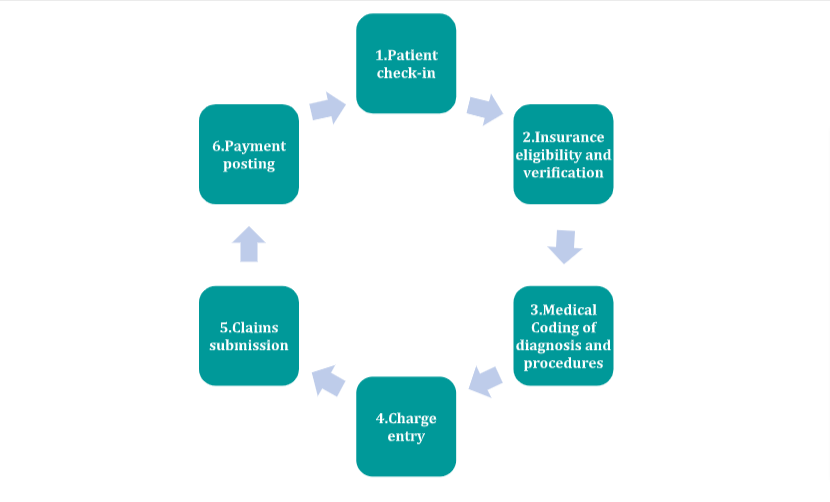

Cycle of claiming process

Cycle of claiming process

- Patient check-in

Patient registration is done at the time of check-in. The first step in the medical billing process is patient registration. When a patient provides their provider with personal and insurance information, registration takes place.

- Insurance eligibility and verification

The care provider must confirm the patient’s insurance after the patient registers. This confirms that the patient has sufficient insurance to cover the care they will receive. Verification aids in determining eligibility and coverage and evaluates the following:

- Benefits of the patient’s policy

- Whether patient has co-payments, deductibles, or out-of-pocket expenses

- Whether the patient’s insurance provider requires pre-authorization

- Medical coding

After care has been given, a crucial step called medical coding takes place. Care providers convert their notes and other clinical paperwork into standardized medical codes.

- Charge entry

Charge entry is the last step before care providers submit their claim for payment. Providers or medical billing specialists list the charges that they expect to receive.

- Claims submission

Claims transmission is when claims are transferred from the care provider to the payor. In most cases, claims are first transmitted to a clearinghouse. The clearinghouse reviews and reformats medical claims before sending them to the payor.

- Payment posting

Once the payor has reviewed a medical claim and agreed to pay a certain amount, they bill the patient for any remaining costs.

There are many medical claim companies around the world that provide healthcare insurance and related services. Here are some of the major medical claim companies around the world, based on their size, market share, and overall industry influence:

- UnitedHealth Group (United States)

- Anthem Inc. (United States)

- Aetna, a CVS Health company (United States)

- Cigna Corporation (United States)

- Humana Inc. (United States)

- Kaiser Permanente (United States)

- Blue Cross Blue Shield Association (United States)

- Bupa (United Kingdom)

- AXA (France)

- Allianz (Germany)

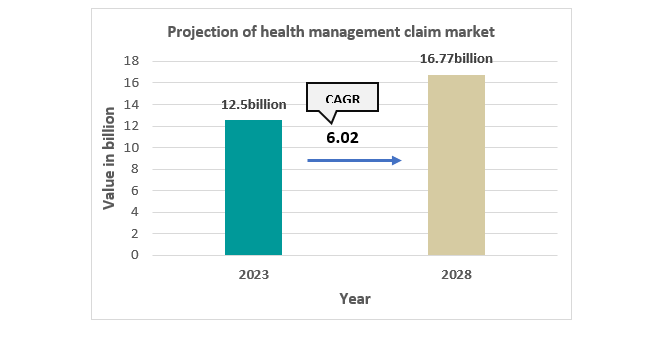

Market size

The Healthcare Claim Management Market is expected to register a CAGR of nearly 6.02% during the forecast period of 2023-2028.

Market growth drivers

Rising healthcare costs

Increasing demand for healthcare services

The need for efficient and effective management of medical claims

Advances in technology, such as the use of artificial intelligence and data

analytics, are also expected to drive growth in the medical claim company

market by improving the accuracy and efficiency of claims processing

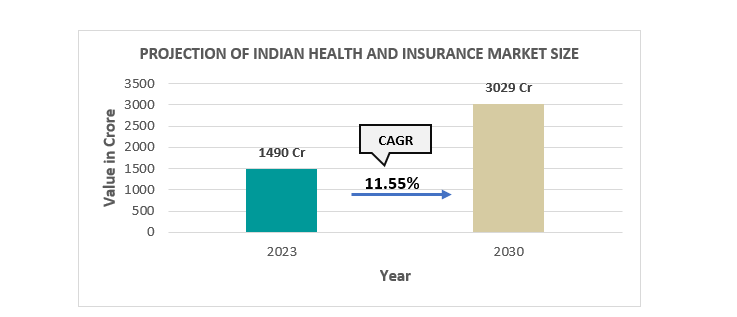

Indian scenario

India Health and Medical Insurance Market is expected to achieve a CAGR of 11.55% by 2030.

Health insurance is a major contributor to the expansion of the general insurance market in India. It contributes to approximately 29% of total general insurance premium income in India.

Maharashtra state dominated the India health insurance market in 2022. In India, Maharashtra accounts for the largest percentage of insurance premiums. Mahatma Jyotiba Phule Jan Arogya Yojana offers coverage for a variety of medical costs incurred as a result of the insured’s hospitalization for a sum insured amount of INR 1.5 Lakh annually.

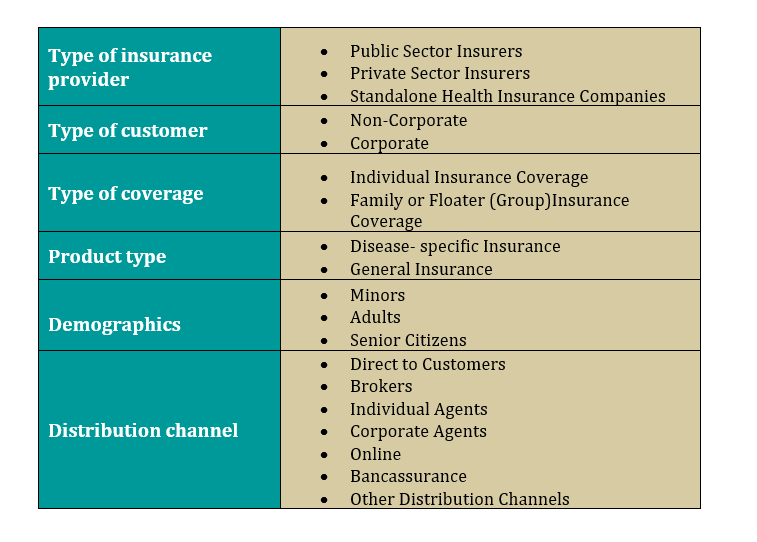

Segmentation of medical claim market

Some of the Indian market players are:

- Star Health

- Aditya Birla

- Niva Bupa Health Insurance (Formerly known as Max Bupa Health Insurance)

- Bajaj Allianz Health Insurance

- Bharti AXA Life Insurance

- Reliance Health Insurance

LIC, New India, National Insurance, United Insurance, and Oriental are the only government-controlled companies that stand high in terms of both market share and contribution to the Indian insurance industry.

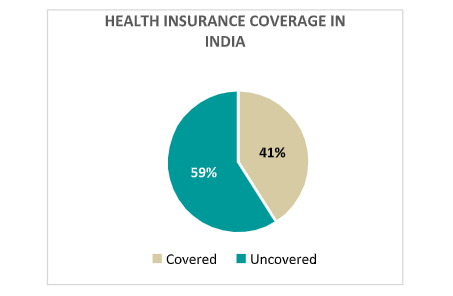

Health insurance coverage in India

Approximately 41% of the Indians are covered under health insurance programs.

Conclusion

It’s worth noting that the health insurance coverage in India varies widely based on factors such as income, employment status, location, and other socioeconomic factors. While the government has taken several steps to increase health insurance coverage in India, there is still a significant portion of the population that is not covered by health insurance, and out-of-pocket expenditures on healthcare remain a significant burden for many households.

For and market and financial feasibility study you can visit the company website on www.hospaccxconsulting.com