I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Are you planning to build or restructure or venture into diagnostics in India? Looking for information about the major healthcare players in Government and Private centers that are available in India? Are you looking to find out which part of the city is best to venture into or what all facilities are available and what should be planned for the new setup? In this article, Hospaccx Healthcare Consultancy has mapped all on major players in terms of the Diagnostics market scenario in India.

INTRODUCTION

Diagnostic services act as an intermediary in India’s healthcare industry. They offer vital information for the correct diagnosis and treatment of diseases. The diagnostic services are categorized mainly into :

- Pathology testing or invitro diagnosis service

- Imaging diagnosis or radiology services

- Wellness and preventive diagnostic services.

Pathology testing contributes ~70% of the market share, whereas radiology tests account for the rest. Indian diagnostic services are provided at the lowest price in the world. The industry is mainly volume-oriented. As a result, the testing price hasn’t increased or marginally increased (5%-7%) in the last five years.

DIAGNOSTIC MARKET SIZE IN INDIA

- The diagnostic industry is one of the fastest-expanding service verticals in India. The domestic diagnostic sector is pegged at $9.5 billion, and it is anticipated to increase at ~11% CAGR over the next five years.

- The rising target disease burden, growing geriatric population, and introduction of technologically advanced products are the major factors driving the growth. Furthermore, the region reports an increase in the demand for POC facilities which is driving the industry’s growth. However, high prices of molecular diagnostic tests and poor reimbursement policies in the country are anticipated to restrain market growth.

DIAGNOSTIC GROWTH MARKET DRIVERS IN INDIA

- Increasing prevalence of chronic diseases: The growing burden of chronic diseases such as diabetes, cardiovascular disorders, and cancer in India has led to a higher demand for diagnostic tests. The need for accurate and timely diagnosis to facilitate effective disease management is driving the growth of the diagnostic market.

- Rising awareness and healthcare expenditure: Improved healthcare awareness among the population, coupled with increased healthcare spending, has contributed to the expansion of the diagnostic market in India. Individuals are more proactive in seeking preventive healthcare measures and early disease detection, leading to higher demand for diagnostic tests.

- Technological advancements: Advancements in diagnostic technologies, such as point-of-care testing, molecular diagnostics, and digital pathology, have revolutionized the diagnostic industry in India. These innovations offer faster, more accurate, and more convenient testing options, leading to increased adoption and market growth.

- Medical tourism: India has emerged as a popular destination for medical tourism due to its high-quality healthcare services at affordable prices. The availability of advanced diagnostic facilities and expertise attracts patients from abroad, contributing to the growth of the diagnostic market in the country.

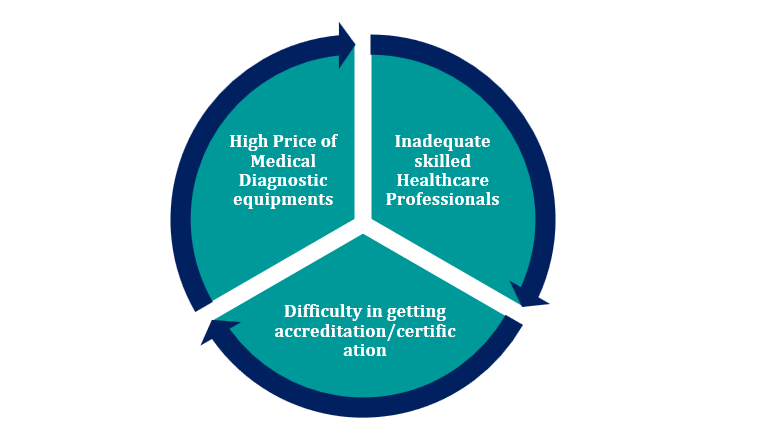

DIAGNOSTIC MARKET CHALLENGES IN INDIA

MARKET SEGMENTATION

The major types of clinical diagnostics are:

- Molecular Diagnostics

- Immunodiagnostics

- Clinical Chemistry

Based on molecular diagnostic technology, the market is categorized into:

- Microarray/ DNA and Gene Chip

- Next Generation Sequencing

- PCR Technology

Based on product, the clinical diagnostics industry is classified into:

- Instruments and Consumables

- Services

The market can be broadly categorized based on test location into:

- Point of Care (POC)

- Self-Test or OTC

- Central Laboratories

RECENT DEVELOPMENTS IN INDIA:

- In June 2022, Orange Health must have announced the commencement of its services in New Delhi as a component of its optimistic geographical expansion strategy. Customers in the NCR region can now access a variety of diagnostic services in just 1 hour from the convenience of their homes, with the information provided in 6 hours.

- In March 2022, MedPlus Health Services opened a diagnoses hub in Gachibowli with PNDT and AERB authorizations. It is an expansion of the current Labs segment and would encompass radiology and pathophysiology services.

GOVERNMENT INITIATIVE FOR DIAGNOSTIC CARE IN INDIA

| NHM Free Diagnostics Service Initiative

Aim: It is to ensure availability and access to diagnostic tests at public health facilities to reduce the out-of-pocket expenditure incurred by patients on diagnostics. About: The government of India under the National Health Mission launched the Free Essential Diagnostics Initiative to address the high out-of-pocket expenditure on diagnostics (10% OOPE on the cost of diagnostics – 11% in OPD and 9.6% in IPD as per NSSO 71st round) and improve quality of healthcare services. |

LIST OF DIAGNOSTIC CARE CENTRES IN INDIA

Chain of Diagnostic Centres in India

- SRL Diagnostics

It is a diagnostic company based out in Mohali providing diagnostic services in pathology and radiology. It was established in 1995. It has corporate offices in Gurgaon, New Delhi , and Mumbai, the company has 356 networking laboratories, including 4 Reference Labs, 4 Centres of Excellence, 26 radiology/imaging centers, 40 NBL accredited labs, 4 CAP accredited labs, and a footprint spanning over 100 collection points.

- Lal Path Labs Limited

It is an international service provider of diagnostic and related healthcare tests. Dr. Lal Path Labs was started in 1949, by the late Dr. S. K. Lal. The first laboratory was set up by Dr. S.K Lal in Delhi, India. In 2013, Dr. Lal Path Labs was awarded Best Diagnostic Service Company by VC Circle. The company has 170 laboratories and diagnostic centers with approximately 1500 collection centers across India.

- Thyrocare Technologies Limited

It is a chain of diagnostic and preventive care laboratories, based in Navi Mumbai. The company has 1,122 outlets and collection centers across India and parts of Nepal, Bangladesh , and the Middle East. Thyrocare was started in 1996, by A. Velumani, ex-scientist at Bhabha Atomic Research Centre (BARC), Mumbai, Maharashtra. The first laboratory was set up in Byculla, Mumbai. It is ISO 9001:2008 and National Accreditation Board for Testing and Calibration Laboratories (NABL) accredited.

- Metropolis Labs

It is a chain of diagnostic companies, with its central laboratory in Mumbai, Maharashtra. Metropolis Healthcare has a chain of 125 labs and 800 collection centers. It was founded in 1981 by Dr Sushil Shah (Chairman, of Metropolis Healthcare).

- MEDALL Healthcare Pvt.Ltd

It was established in 1994. It is a chain of medical diagnostic service providers based in India. Established by Mr. Raju Venkatraman. They are the 4th largest Indian Diagnostic players and NABL & ISO accredited.

- Apollo Diagnostics

Apollo Diagnostics is the corporate credo of bringing quality, affordable healthcare closer to the consumer, 2015 saw 100+ Apollo Diagnostics centers, in 2016 it has grown to 150+ centers, and in 2017 landed with 250 + collection centers, 70+ Labs springing up in neighborhoods across India.

- Lifecare Diagnostics

It was established in 1995, Lifecare is the country’s premier full-service diagnostic center with a laboratory, providing expertise in imaging and digital pathology services.

- Suburban Diagnostics

It is the front-runner in world-class diagnostic services since 1994. It offers a comprehensive menu of pathology, radiology, and cardiology tests along with value-added services. It has been accredited by CAP since 2014 and NABL since 2003.

- Mahajan Diagnostics

It was established in 1992. There are currently 10 centers with standalone centers in SDA, Defence Colony, Pusa Road, Gurugram, and Bali Nagar in Delhi NCR and other centers located in prestigious hospitals including Sir Ganga Ram Hospital, Fortis Hospitals in Vasant Kunj & Jaipur, PSRI Hospital and at the Sports Injury Centre at Safdarjung Hospital. It is a chain of High-End Integrated Diagnostic centers in India that combine Radiology, PET CT & Nuclear Medicine, Genomics, Pathology, and Artificial Intelligence.

CONCLUSION

The diagnostic market scenario in India has witnessed significant growth and development in recent years. With a rising focus on healthcare and increasing awareness about preventive healthcare measures, the demand for diagnostic services has been on the rise. The market is expected to continue expanding as healthcare awareness increases and the demand for accurate and timely diagnostic services rises. However, addressing challenges related to infrastructure, manpower, and affordability will be crucial for the sustainable growth of the sector.

Above is the superficial and macro level study for in-depth market and financial feasibility studies or any other healthcare-related research needs, please feel free to reach out to us at +91-8655170700 or email us at hospaccx.india@gmail.com . Our team is equipped to provide comprehensive and detailed insights tailored to your specific requirements.

Related Team Members